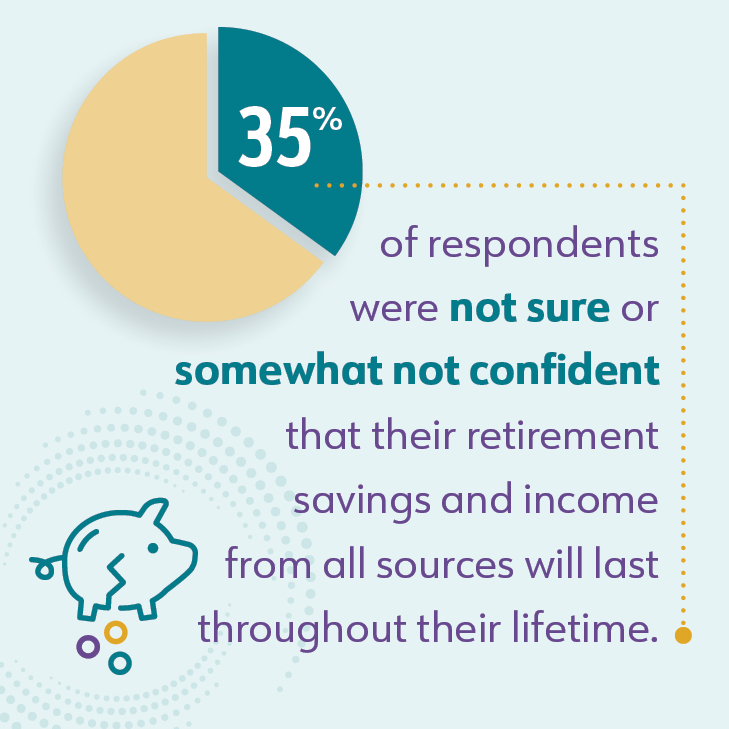

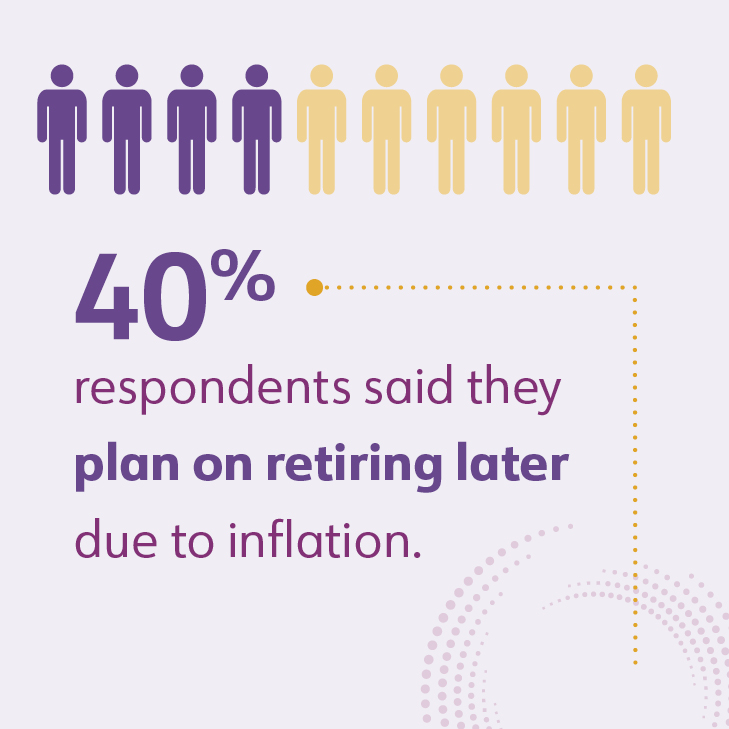

See how participants responded to our post-webinar survey.

Earlier this year, we held our annual New Year, New Markets? webinar, where we reviewed the market’s performance in 2023 and provided insights about the economic outlook for 2024. Following the webinar, we surveyed attendees to understand their own financial outlook.

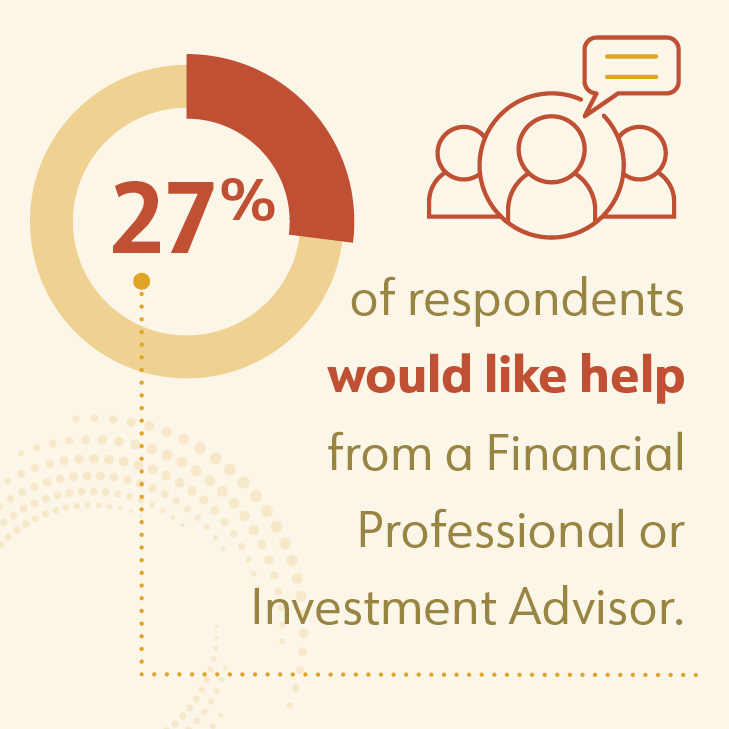

The survey results highlighted the following:

ABA Retirement Funds Program (“Program”) resources are available to all participants.

Read on to find ways to connect your participants with the support they’re looking for.

Educational Webinar Series: Throughout the year, we’ll be inviting participants to our live webinars on:

- The Foundations of Financial Wellness,

- The Benefits of Their Retirement Plan, and

- Making the Most of Social Security.

In addition, participants can access our library of on-demand educational videos on topics like budgeting, estate planning, and healthcare in retirement at any time within our Learning Center.

Encourage your participants to visit our webinar registration page so they can add our upcoming live webinars to their calendars.

Online Participant Account Dashboard: When participants log in to their retirement plan account through abaretirement.com, they can have a comprehensive view of their finances – all in one place. With the ability to add in their outside accounts (checking, savings, credit card, 529, etc.), participants can monitor their spending, create a budget, and see how close they are to reaching their financial goals. They can also receive insights and personalized action steps based on their spending and saving patterns. Promote account engagement with your employees by sharing this email with them.

Financial Advice: All of your employees, regardless of whether they are plan participants, can work with financial professionals for help with their whole financial picture – both within their retirement plan and beyond. Provide employees with this link so they can learn more: abaretirement.com/financialadvice.

The Program is committed to helping your participants on their financial journey. We’ll keep you informed of participant-facing resources and communications throughout the year with our “Did You Know?” email series, sent from abaretirementcommunications@voya.com.