Reading Time: 4 minutes

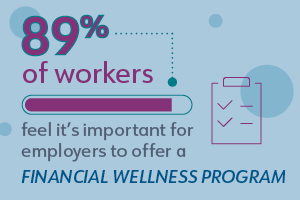

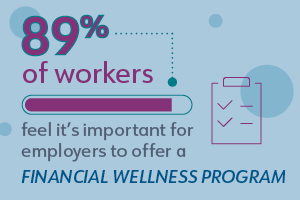

A recent study examined the connection between employees’ stress, finances, and well-being. One of the key takeaways is that employees would like help from their employers when it comes to their financial wellness.

Fortunately, the ABA Retirement Funds Program (“Program”) provides services relating to your employees’ financial wellness needs and interests. Workers are looking for help from their employer with:

Recommendations on Social Security strategies

Recommendations on Social Security strategies

An on-demand video on the Basics of Social Security is featured within Program Learn.

Live, in depth Social Security Webinars and Q&As were held recently for Program participants. A recorded version is available in the Learning Center.

Social Security Guidance, offered through Voya Retirement Advisors (“VRA”)1, compares different Social Security strategies and provides clear steps to put guidance into action. Available within the Investment Advice section of a participant’s Program account after logging in.

Help forecasting retirement income

Help forecasting retirement income

myOrangeMoney: This educational experience pops up when participants log into their Program account. An interactive orange dollar bill lets employees estimate how much income they may need for retirement, find out if they’re on track, and learn how small changes to their savings or retirement date may help them get closer to their goals.

Access to expertise on estate planning

Within Program Learn, participants will find an on-demand video overview of Estate Planning.

Within Program Learn, participants will find an on-demand video overview of Estate Planning.

Live Estate Planning Webinars and Q&As were held recently to walk Program participants through important needs and considerations. A recorded version is available in the Learning Center.

The Program offers a comprehensive Estate Planning Strategies guide to help participants with certain aspects of getting their estate in order.

Ability to assess financial wellness and gaps

Ability to assess financial wellness and gaps

Financial Wellness Experience: Available after account login, participants can take a brief, interactive assessment to evaluate key areas of financial wellness (e.g., emergency savings, debt management, retirement readiness) and receive a summary of their results in real time. They will gain access to a dashboard with financial wellness education, fully personalized based on their results.

IMPORTANT: The illustrations or other information generated by the calculators are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. This information does not serve, either directly or indirectly, as legal, financial or tax advice and you should always consult a qualified professional legal, financial and/or tax advisor when making decisions related to your individual tax situation.

1 IMPORTANT: Forecasts, projected outcomes or other information generated regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. In addition, results may vary each time a forecast is generated for you.

Advisory Services provided by Voya Retirement Advisors, LLC (“VRA”). VRA is a member of the Voya Financial (“Voya”) family of companies. For more information, please read the Voya Retirement Advisors Disclosure Statement, Advisory Services Agreement and the ABA Retirement Funds Program’s (“Program’s”) Fact Sheet. These documents may be viewed online by accessing the advisory services link(s) through the Program’s web site at abaretirement.com after logging in. You may also request these from a VRA Investment Advisor Representative by calling the Program’s information line at 800.348.2272. Financial Engines Advisors L.L.C. (“FEA”) acts as a sub advisor for VRA. FEA is a federally registered investment advisor. Neither VRA nor FEA provides tax or legal advice. If you need tax advice, consult your accountant, or if you need legal advice, consult your lawyer. Future results are not guaranteed by VRA, FEA or any other party and past performance is no guarantee of future results. Edelman Financial Engines® is a registered trademark of Edelman Financial Engines, LLC. All other marks are the exclusive property of their respective owners. FEA and Edelman Financial Engines, LLC are not members of the Voya family of companies. ©2022 Edelman Financial Engines, LLC. Used with permission.

Please read the Program Annual Disclosure Document (April 2022) carefully before investing. This Disclosure Document contains important information about the Program and investment options. For email inquiries, contact us at: contactus@abaretirement.com.

Registered representative of and securities offered through Voya Financial Partners, LLC (Member SIPC). The ABA Retirement Funds Program, the Voya family of companies, Mercer Trust Company, and TD Ameritrade, Inc., are all separate, unaffiliated companies and not responsible for one another’s products and services.

CN2283939_0724

Recommendations on Social Security strategies

Recommendations on Social Security strategies Help forecasting retirement income

Help forecasting retirement income

Within Program Learn, participants will find an on-demand video overview of Estate Planning.

Within Program Learn, participants will find an on-demand video overview of Estate Planning. Ability to assess financial wellness and gaps

Ability to assess financial wellness and gaps